Revenue and Expense Recognition

Content

Let’s remember that $1,000 is probably not material to the financial statements. I have written notes to financial statements that have been filed with the SEC.

Examples of contra assets include Accumulated Depreciation and Allowance for Doubtful Accounts. Unlike an asset which has a normal debit balance, a contra asset has a normal credit balance because it works opposite of the main account. A company might use a combination of different types of asset accounts, and the following six types of contra asset accounts can be used in conjunction with these fixed and current asset accounts. In this article, you will learn what a contra asset account is, the types of contra asset accounts a business may have as well as an example of how common types of contra asset account balances are calculated. The normal balance for asset and expense accounts is the debit side, while for income, equity, and liability accounts it is the credit side.

Income Statement Explained

The scope should not be defined in the context of contracts with customers. Consideration provided in the form of a financing component is in the scope developing measurement guidance.

If the company withholds $2,000 from its employees’ wages to pay part of the cost of the insurance, the company will credit its contra expense account 4211 Employee Withholdings for Health Ins. In other words, this account’s credit balance is contrary to the usual debit balance for an expense account. The Board continued by discussing stakeholder feedback on Scope Exclusion Principle and tentatively reaffirmed its decision not to include guidance related to capital assets and inventory in the scope of the project. The Board also discussed the possibility of reconsidering decisions with regard to certain capital asset transactions when considering measurement proposals.

What is a Contra Account? Definition

Alicia Tuovila is a certified public accountant with 7+ years of experience in financial accounting, with expertise in budget preparation, month and year-end closing, financial statement preparation and review, and financial analysis. She is an expert in personal finance and taxes, and earned her Master of Science in Accounting at University of Central Florida. In terms of the journal entries, the debit balance in “Discount on Bonds Payable” is subtracted from the credit balance in the “Bonds Payable”. Buy Back Its StockShare buyback refers to the repurchase of the company’s own outstanding shares from the open market using the accumulated funds of the company to decrease the outstanding shares in the company’s balance sheet.

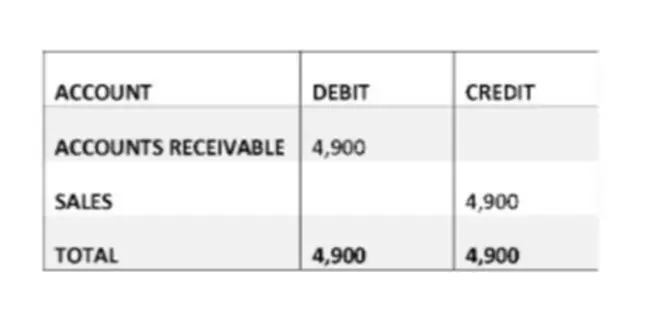

The totals show the net effect on the accounting equation and the double-entry principle, where the transactions are balanced. An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts expected to be paid. A contra liability account is a liability account that is debited in order to offset a credit to another liability account. By keeping the original dollar amount contra expenses intact in the original account and reducing the figure in a separate account, the financial information is more transparent for financial reporting purposes. For example, if a piece of heavy machinery is purchased for $10,000, that $10,000 figure is maintained on the general ledger even as the asset’s depreciation is recorded separately. Key examples of contra accounts include accumulated deprecation and allowance for doubtful accounts.

Living Wage Calculation for Contra Costa County, California

Revenue recognition for certain intangible assets out of scope of Statements 51, 87, 94, and 96. The Board continued deliberations on the Revenue and Expense Recognition project by discussing stakeholder feedback related to the proposed categorization methodology and comprehensive model. The Board discussed the types of recognizable items of information that could potentially be identified as transactions, or as other events if not identified as transactions. The Board provided feedback on the issues identified and discussed the general direction the project staff should take in the development of proposals for future meetings.

- The Board tentatively decided to retain a rebuttable presumption of enforceability as a characteristic of a binding arrangement.

- The accounts normally have a credit balance and in use are offset against the purchases account which is normally a debit balance.

- Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services “on credit” and have experience with the collectability of those accounts.

- Balance sheet, users of financial statements can learn more about the assets of a company.

- Future deliberations will address whether the assessment of enforceability should be made as part of the scope or in the categorization step.

- The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be paid by customers.

A transaction is an agreement between the buyer and the seller for the exchange of goods and services. Cash and credit transactions https://www.bookstime.com/ are two main types of transactions that are in practice. Explain when to use allowance for doubtful accounts and bad debt expense.